7 questions to ask yourself about retirement

7 questions you should ask yourself before retirement

In this article we will discuss confidence in retiring and some important questions to ask yourself when you start thinking about retirement.

Socialising with mates, enjoying leisurely activities and indulging in the odd trip away are all things that have likely crossed your mind when thinking about how you’ll spend retirement. Beyond that though, have you given much thought to the logistics and what it’ll cost? If you haven’t, you’re not alone.

A 2022 report reveals that almost half (46%) of working Australians don’t know how much they will need to have saved for retirement.

And perhaps this is because so few of us have set specific goals. Only 24% have a financial goal, with the rest of us yet to put pen to paper and flesh out what we’d like to achieve after we finish working.

Given all this, it’s not surprising our confidence about retirement is on the slide. More than one in five (21%) of working Australians are not at all confident they will be able to achieve their desired standard of living in retirement.

So, if you’re thinking of getting on the front foot with your retirement planning, here’s a useful checklist with the big points to consider. At MB+M OzPlan, we are happy to talk you through your options and help make your life easier.

Do I have to retire by a certain age?

The retirement age in Australia isn’t set in stone. You can retire whenever you want to, but factors that could play a part might include:

- your health

- financial situation

- employment opportunities

- your (and your partner’s) individual preferences

- the age you can access your super (from ages 55-60, depending on your DOB)

What’s on my bucket list?

Think about what you may like to do in retirement and what the bigger and smaller priorities may be. Consider things such as:

- your social life and recreation

- staying active and healthy

- different retirement living options, which might include relocating to a new city

- helping the kids, if you have any

How much money will I need?

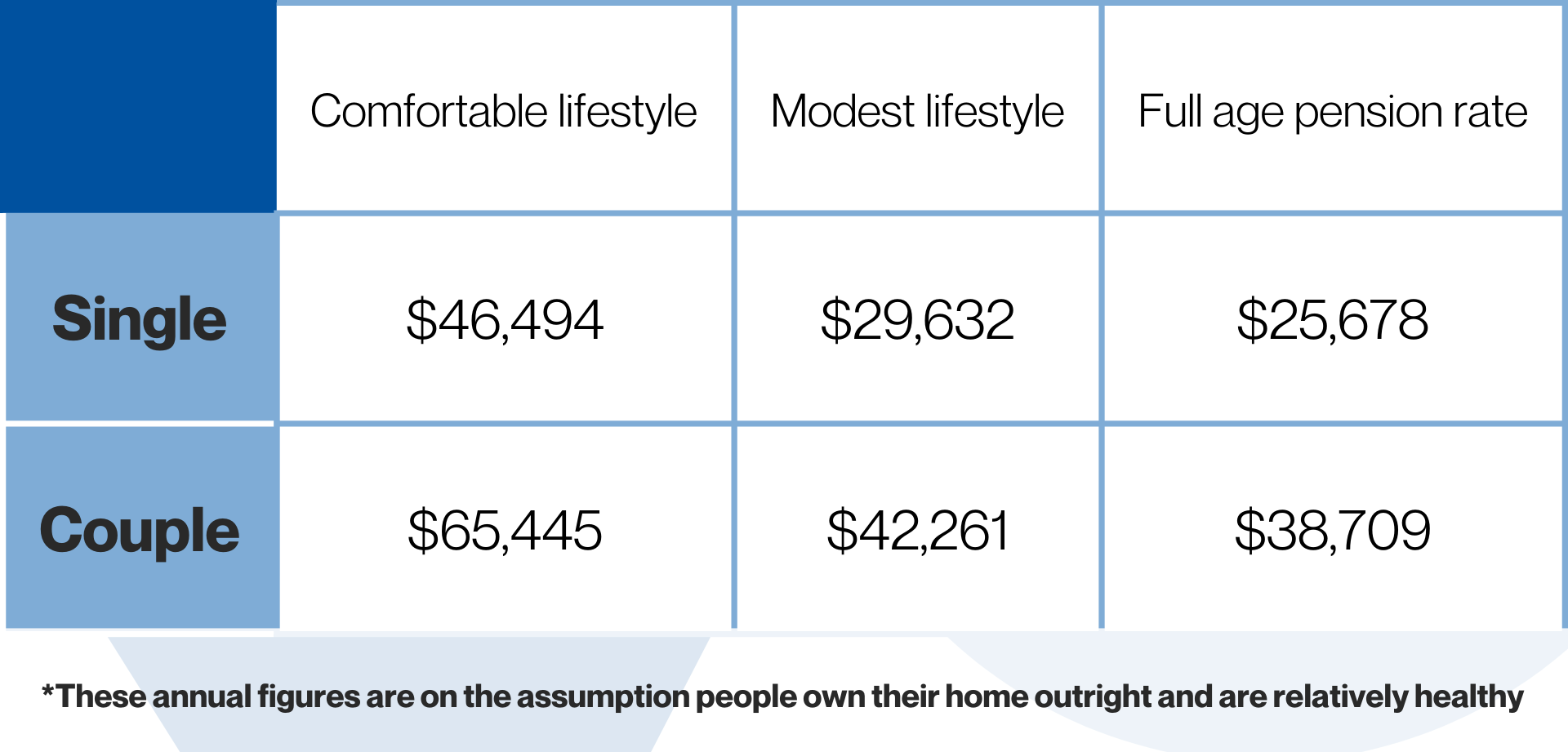

According to the Association of Superannuation Funds of Australia’s (ASFA) June 2022 figures, individuals and couples around age 65 who are looking to retire today would need an annual budget of around $47,383 or $66,725 respectively to fund a comfortable lifestyle.

All these ASFA figures are based on the assumption people own their home outright and are relatively healthy and are compared to the Government’s current maximum age pension rates below. (These rates assume the maximum pension supplement and the energy supplement).

Do I really need 1 million dollars?

For most people, it will certainly be less than the figure of $1 million or more that is often bandied around. So, it’s timely that new research shows you may need less than you fear.

For most people, the amount you need to save will depend on how much you wish to spend in retirement to maintain your current standard of living. One way of doing that is to look at how much you spend now.

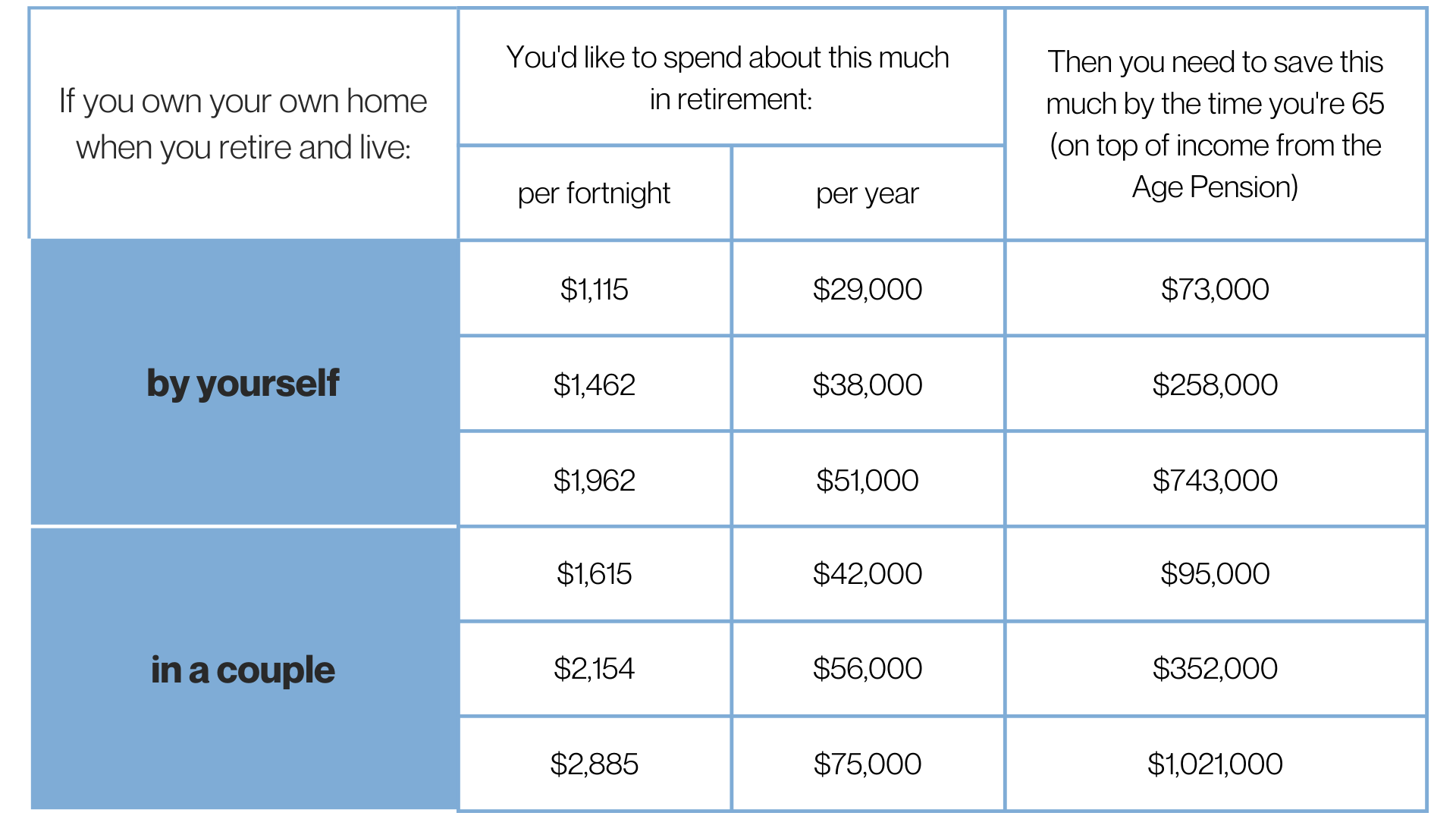

As you can see in the table below, Super Consumers Australia (SCA) estimated retirement savings targets for three levels of spending – low, medium and high – for recently retired singles and couples aged 65 to 69.

Significantly, only so-called high spending couples who want to spend at least $75,000 a year would need to save more than $1 million. A couple hoping to spend $56,000 a year would need to save $352,000. High spending singles would need $743,000 to cover spending of $51,000 a year, and $258,000 for medium annual spending of $38,000.

Where will my money come from?

The money you use to fund your life in retirement will likely come from a range of different sources, such as:

Your super fund

Generally, you can start accessing super when you reach your preservation age, which will be between 55 and 60, depending on when you were born, and retire. Knowing your super balance is a crucial part of planning for retirement, as it’s likely to form a substantial part of your savings.

If you’ve got more than one super account, there may also be advantages to rolling your accounts into one, such as paying one set of fees. However, there could be certain features lost in the process, such as insurance, so make sure you’re across everything before you consolidate.

Investments, savings or an inheritance

You may be planning to sell or use income you’re generating from shares or an investment property or use money you’ve saved in a savings account or term deposit to contribute to your retirement. An inheritance or proceeds from your family’s estate may also help in your later years.

Government benefits

Depending on your circumstances, as well as your income and assets, you may be eligible for a full or part age pension from age 65 to 67 onwards (depending on when you were born), or you might not be eligible at all. Along with your savings, government benefits, such as the Age Pension, as well as Carer’s Allowance and the Disability Support Pension, could be an important part of your retirement income.

What other matters will I need to address?

Existing debt

When planning retirement, you may want to consider what outstanding debt you have and ways you may be able to reduce it while you’re still earning an income.

Insurance

You might have personal insurance, possibly tied to your super fund, but it’s worth checking you have the right type and that it’s appropriate for you. After all, what you require in retirement could be quite different to when you’re working.

Investment preferences

Investments are part of many retirement planning strategies, and when you’re retiring, it’s worth reviewing your investment style and the options you’ve chosen.

Estate planning, including your will

It’s important to think about your estate planning needs. For instance, have you documented how you want your assets to be distributed after you’re gone and how you want to be looked after if you can’t make decisions later in life? MB+M have Estate Planning Specialists who can help discuss your options.

How can I withdraw my super?

Depending on how you withdraw your super and at what age, there will be different tax implications worth investigating, which will depend on your individual circumstances.

We can help you identify your goals and provide advice on how you can achieve them.

Our financial advisors are happy to have a chat about your situation and help you prepare now so you can have peace of mind later. Please give us a call on (03) 5831 1233.

We also have an interesting article about Aged Care you can read here: Are you prepared for Aged Care?

Sources

- Financial Wellness Support Hub – AMP

- Your 7 Point Retirement Planning Checklist – AMP

- Retirement Targets — Super Consumers Australia

Disclaimer:

The information provided on this website is general in nature only and does not constitute personal financial advice. OzPlan Financial Services (AFSL 221235, ABN 35 005 391 202) do not take into account the objectives, financial situation, or needs of any individual. We recommend you obtain financial, legal, and taxation advice before making an investment decision. Before acting on information on this website you should consider the appropriateness of the information to your situation and needs. OzPlan Financial Services do not guarantee investment returns or the repayment of capital.