Salary sacrifice – Tips for employers

MB+M Tax Team provides useful information: Salary sacrifice – Tips for employers

Allowing your employees to salary sacrifice can help them reduce their tax bill and it boosts engagement with your business. Another overlooked benefit is if your employee salary sacrifices into their super, you can claim a tax deduction for their contributions, as they are considered employer contributions.

To do this, you need to ensure you create an ‘effective’ salary sacrifice arrangement meeting the ATO’s guidelines. Otherwise the benefits your employee receives are considered part of their taxable income.

Effective arrangements require a clear agreement stating the terms and conditions and they must be documented in writing to avoid any uncertainty or future disputes.

Sacrifice arrangements can only apply to wage and salary payments for work yet to be performed, not past earnings. Salary and wages, leave entitlements, bonuses or commissions accrued prior to the arrangement cannot be used.

A simple way to avoid problems is to document your employees’ salary sacrifice arrangements before the start of a new financial year – or whenever there is a change to their salary – so it covers future earnings.

If your employee chooses to sacrifice into their super, you must pay it into a complying super fund or it will be considered a fringe benefit. Generally, there is no limit on the amount an employee can salary sacrifice into super, however if they exceed their concessional cap they will pay additional tax.

You need to keep detailed records of these arrangements for five years and list all sacrifice amounts on the employee’s annual payment summary.

Case Study – How using salary sacrifice can boost your Super

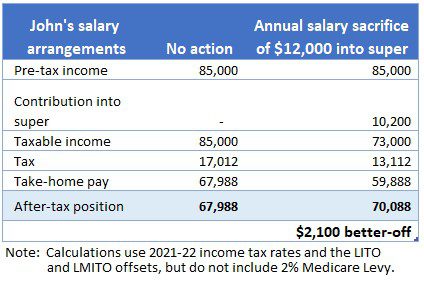

John earns $85,000 before tax and before his employer’s 10% Superannuation Guarantee (SG) contribution.

He has a salary sacrifice arrangement with his employer allowing him to contribute $12,000 from his pre-taxed salary into his super account. These salary sacrifice contributions are taxed at 15% when they enter his account, resulting in a $10,200 annual contribution.

By using this arrangement, John pays less tax overall and boosts his retirement savings.

If you would like help working out if a salary sacrifice arrangement makes sense for your business, call MB+M on 03 5821 9177 today.

Related articles:

Published 16 May 2022.

The information provided in this article is general in nature only and does not constitute financial advice.